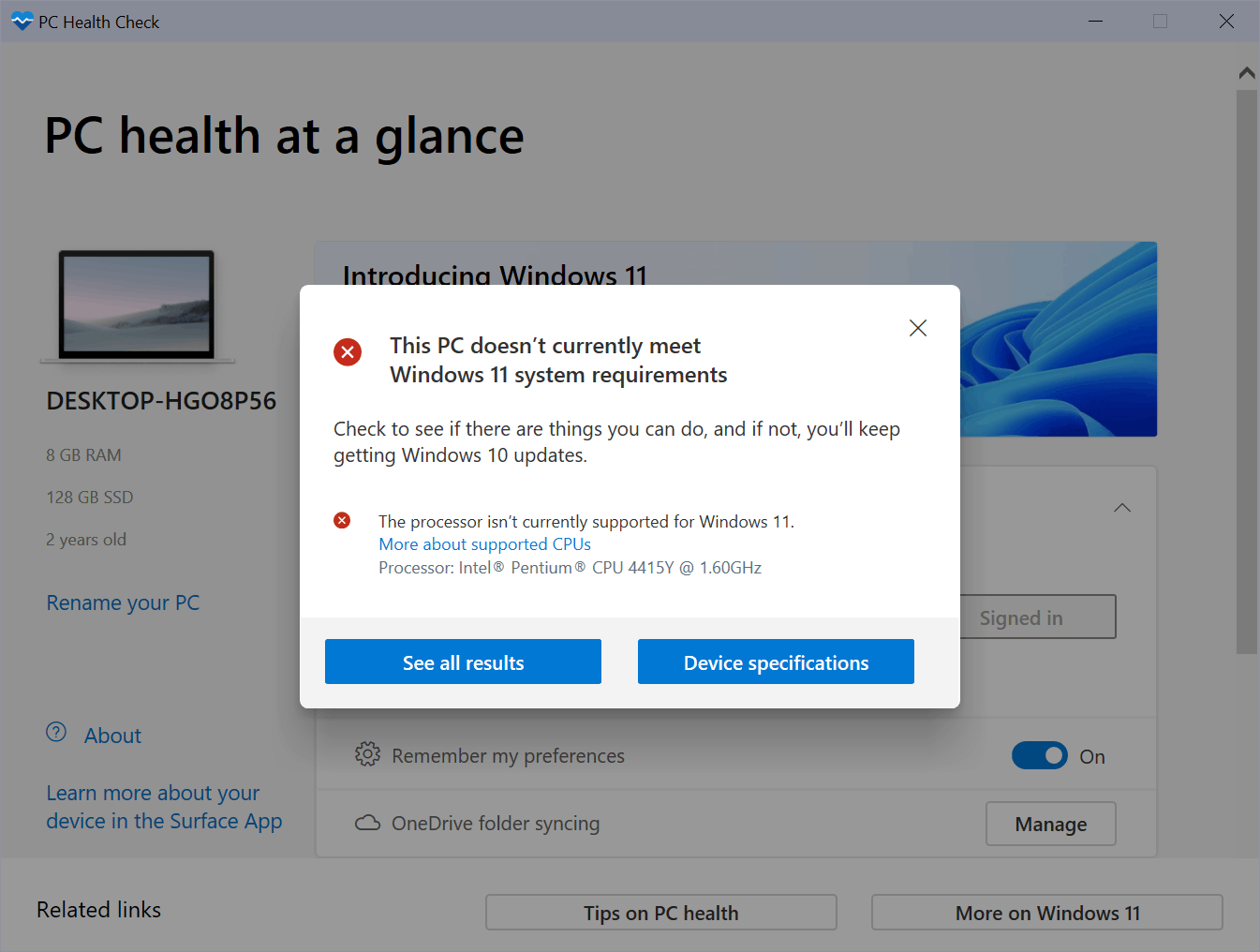

نمی دانید آیا رایانه ای با ویندوز با سیستم عامل مایکروسافت به زودی ویندوز 11 سازگار است؟ مایکروسافت الزامات سیستم ویندوز 11 را به طور قابل توجهی تغییر داد و بسیاری از دستگاه هایی که از ویندوز 10 یا نسخه های قبلی ویندوز خوب استفاده می کنند در نتیجه با ویندوز 11 سازگار نخواهند بود. نسخه جدید ویندوز در 5 اکتبر 202.1 منتشر می شود هنگامی که ویندوز 11 را به طور رسمی معرفی کرد ، ابزار PC Health Check آن را بررسی کرد. این ابزار فقط برای Insiders در دسترس بود و بررسی می شد که آیا رایانه ای که روی آن کار می کرد با سیستم عامل ویندوز 11 مایکروسافت سازگار بود یا خیر. این شرکت بلافاصله پس از آن ابزار را کنار گذاشت و قول داد که قبل از انتشار نسخه به روز شده آن را منتشر کند. ویندوز 11. نسخه به روز شده برای Insiders مدتی پیش به صورت انحصاری منتشر شد. این نسخه عمومی ابزار در حال حاضر در دسترس است. کاربران علاقه مند می توانند برنامه رسمی PC Health Check را از وب سایت ویندوز 11 مایکروسافت بارگیری کنند. برای بارگیری برنامه نرم افزاری در سیستم محلی ، باید تا انتهای صفحه پایین بروید و روی پیوند "بارگیری برنامه PC Health Check" کلیک کنید. آن را اجرا کنید ، دکمه "اکنون بررسی کنید" را در بالا فشار دهید ، نسخه به روز شده برنامه اطلاعات اضافی در مورد مشکلات احتمالی سیستم را نمایش می دهد. لپ تاپ پیر Surface Go نویسنده مطابق با Windows 11 سازگار نیست ابزار به دلیل پردازنده آن پردازنده فهرست شده است و پیوند ارائه شده یک وب سایت Docs مایکروسافت را باز می کند که در مورد پردازنده های سازگار اطلاع می دهد و شامل پیوندهایی به لیست همه پردازنده های پشتیبانی شده است. نسخه اصلی ابزار این اطلاعات را ارائه نکرده است. این فقط بیان داشت "این رایانه نمی تواند ویندوز 11 را اجرا کند" و کاربر را در تاریکی نگه داشت. ابزارهای مورد نیاز ویندوز 11 شخص ثالث برای پر کردن شکاف ایجاد شد. شما می توانید Windows 11 Requirements Check Tool یا این مرور Win11SysCheck و WhyNotWin11 را بررسی کنید. یکی می تواند استدلال کند که واقعاً مهم نیست که کدام قطعه دستگاه سازگار نیست ، زیرا منجر به عدم امکان ارتقاء به نتیجه ویندوز 11 می شود. در حالی که این امر در مورد دستگاه هایی با اجزای سخت افزاری ثابت صادق است ، به عنوان مثال. یک لپ تاپ یا دستگاه Surface Go ، لزوماً برای رایانه های شخصی بدون اجزای ثابت صادق نیست. یک کاربر می تواند پردازنده را در صورت عدم سازگاری ارتقا دهد ، حتی گاهی اوقات بدون جایگزینی مادربرد یا سایر اجزای موجود در این فرآیند. برخی از فروشندگان بسته های ارتقاء را ارائه می دهند که شامل مادربرد جدید ، پردازنده و RAM ، در یک بسته واحد ، برای ارتقاء آسانتر است. رایانه های شخصی که قابل ارتقا نیستند ممکن است همچنان تحت شرایط خاصی ویندوز 11 را نصب کنند ، اما مایکروسافت عمدا در این زمینه مبهم است. در حالی که این شرکت تأیید کرد که نصب امکان پذیر است ، پیشنهاد کرد که رایانه های ناسازگار با ویندوز 11 ممکن است به روزرسانی نشوند و از نظر ویژگی محدود باشند. ارتقاء اولیه از ویندوز 10 به ویندوز 11 رایگان است ، اما مشخص نیست که آیا مایکروسافت قصد دارد آن را متوقف کند این موارد در یک زمان معین انجام می شود ، یا ارتقاء را به طور نامحدود رایگان نگه می دارد اما فقط به صورت غیررسمی مانند ارتقاء ویندوز 7 و 8.1 به ویندوز 10 انجام شده است. برنامه PC Health Check به خریداران کمک نمی کند. برخی از رایانه های شخصی که می توانند به صورت آنلاین و در مکان های خرده فروشی خریداری شوند با سیستم عامل ویندوز 11 مایکروسافت سازگار نیستند. خریداران باید از فهرست سازگاری پردازنده مایکروسافت و سند سیستم مورد نیاز برای اطلاع از سازگاری رایانه شخصی با ویندوز 11 استفاده کنند ، مگر اینکه فروشنده این موضوع را به صراحت نشان دهد. مایکروسافت قصد دارد تا اکتبر 2025 از ویندوز 10 پشتیبانی کند. ویندوز 11 می تواند در ویندوز 10 باقی بماند یا به ویندوز 10 ارتقا یابد. تنها گزینه قابل اجرا پس از اکتبر 2025 ، تغییر سیستم عامل لینوکس است. برخی ممکن است ترجیح دهند همچنان ویندوز را اجرا کنند ، حتی اگر پشتیبانی نمی شود. حالا شما: برنامه های شما در این زمینه چیست؟ ویندوز 11؟ روی نسخه های قبلی ویندوز بمانید؟ تغییر به لینوکس؟ خلاصه

برنامه سازگاری ویندوز 11 مایکروسافت PC Health Check در حال حاضر برای همه در دسترس است