Talking to PC gamers about Linux is always entertaining, because everyone who knows even a little bit about Linux has a different impression. For some it’s that other operating system they’ve vaguely heard of, and they have about as much interest in it as I have in cars (read: not much). For others it’s a critical part of their work or infrastructure, or it’s the thing their techy friend somehow always manages to bring up in unrelated conversations (ugh, you know how to do everything on the command line, we get it).Last year I decided to become one of the latter and go all-in on desktop Linux. It opened my eyes to how much Linux has changed over the years, and how outdated the idea of Linux as an OS exclusively for tech nerds really is. Not only was the switch relatively painless, but I’m not missing out on much, either—not even gaming.Here’s what it’s like switching from Windows to Linux today, from hardware to software to gaming.The hardwareI’ve played around with various flavors of Linux for about a decade now. I often had the latest version of Ubuntu installed on a secondary desktop or laptop, but never on my main PC. I didn’t particularly feel the need to uproot my existing setups—I was mostly happy with macOS, and later, Windows 7 and 8.1.Windows 10 updates about two years ago broke me. I kept trying new laptops and running into constant frustrations. Windows updates broke my Lenovo Yoga’s hardware drivers on several occasions, sometimes leaving me without a functional keyboard or touchpad. The last straw came when I attempted to restore an automatically-created Windows backup to fix my driver woes, and found out that I soft-bricked the laptop because the backup was corrupted.I didn’t want to buy a MacBook, given Apple was producing laptops with failing keyboards at the time, so Linux it was. You can throw desktop Linux on just about any PC in existence—that’s part of the reason it’s so popular—but I researched machines purpose-built for Linux. There’s always the chance one or two components in Windows PCs won’t work perfectly, and as you can probably tell, I didn’t have the patience for tons more troubleshooting.If you want to buy, rather than build, a Linux system, this is what I learned:System76’s gorgeous desktops (Image credit: System76)System76: The most well-known Linux hardware seller, which makes desktops and laptops with either Ubuntu Linux or the company’s own Pop_OS distribution. While I’m not a massive fan of System76’s laptops (some of them look straight out of 2006), the company’s Thelio desktop line is gorgeous. If you’re looking for a good workstation or gaming rig for Linux, a Thelio is a good option.Purism: Another popular Linux hardware maker, primarily specializing in laptops. Purism’s PCs take privacy to the extreme: they use an open-source UEFI firmware, there are physical kill switches for the microphone/camera/Wi-Fi/Bluetooth, and they ship with a Debian-based distribution called PureOS. However, those features come at a premium: the cheapest Librem 13 laptop costs $1,249. A svelte Purism laptop (Image credit: Purism)Dell: There are also a few mainstream PC manufacturers that produce select models with Linux pre-installed. One of those is Dell, which has sold laptops and desktops designed for Ubuntu Linux for years. However, none of these PCs have dedicated gaming GPUs, so they’re more intended for work than play.In the end, I purchased the Developer Edition of Dell’s XPS 13. I love the design of the company’s laptops, and since I have a full desktop PC for playing games, I didn’t care too much that the XPS 13 had integrated graphics. This laptop was my gateway, and I ended up liking Linux so much, I switched to it on my desktop, too.What software is missing? Actually, not muchI anticipated that I might have to make changes to my workflow and give up some of my favorite applications, so at first I kept my gaming desktop on Windows. Every time I tried some variation of Linux in the past, I couldn’t play most of my games or use many of my favorite services.In 2020, the story is very different.Linux has benefited greatly from recent software trends. The rise of web applications over the past decade means that a lot of the time, your OS doesn’t matter too much. Chrome, Opera, and Firefox are available on desktop Linux (Microsoft Edge is even due to arrive soon). That means Gmail, Spotify, Twitter, Google Drive, Facebook, and most other web apps work just as well on Ubuntu as they do on Windows.The decline of proprietary browser plugins has also been a win for Linux—watching Netflix used to require emulating Internet Explorer with the Silverlight plugin, but in this brave new HTML5-powered world, no such workarounds are required.The growing popularity of the Electron framework for building desktop apps has also benefited Linux. Many developers now build applications that work across Mac, Windows, and Linux. I can use Slack for work, Visual Studio Code for software development, Spotify for music, and Discord for talking to friends—just like I can on Windows. Sadly, Adobe still doesn’t acknowledge Linux exists, so Photoshop remains unavailable.The ecosystem of native desktop applications is also very strong. Beyond the library of cross-platform apps that also support Linux (OBS Studio, VLC Media Player, Dropbox, etc.), there is usually at least one alternative to most popular Windows utilities and applications. Here are a few I use:

A svelte Purism laptop (Image credit: Purism)Dell: There are also a few mainstream PC manufacturers that produce select models with Linux pre-installed. One of those is Dell, which has sold laptops and desktops designed for Ubuntu Linux for years. However, none of these PCs have dedicated gaming GPUs, so they’re more intended for work than play.In the end, I purchased the Developer Edition of Dell’s XPS 13. I love the design of the company’s laptops, and since I have a full desktop PC for playing games, I didn’t care too much that the XPS 13 had integrated graphics. This laptop was my gateway, and I ended up liking Linux so much, I switched to it on my desktop, too.What software is missing? Actually, not muchI anticipated that I might have to make changes to my workflow and give up some of my favorite applications, so at first I kept my gaming desktop on Windows. Every time I tried some variation of Linux in the past, I couldn’t play most of my games or use many of my favorite services.In 2020, the story is very different.Linux has benefited greatly from recent software trends. The rise of web applications over the past decade means that a lot of the time, your OS doesn’t matter too much. Chrome, Opera, and Firefox are available on desktop Linux (Microsoft Edge is even due to arrive soon). That means Gmail, Spotify, Twitter, Google Drive, Facebook, and most other web apps work just as well on Ubuntu as they do on Windows.The decline of proprietary browser plugins has also been a win for Linux—watching Netflix used to require emulating Internet Explorer with the Silverlight plugin, but in this brave new HTML5-powered world, no such workarounds are required.The growing popularity of the Electron framework for building desktop apps has also benefited Linux. Many developers now build applications that work across Mac, Windows, and Linux. I can use Slack for work, Visual Studio Code for software development, Spotify for music, and Discord for talking to friends—just like I can on Windows. Sadly, Adobe still doesn’t acknowledge Linux exists, so Photoshop remains unavailable.The ecosystem of native desktop applications is also very strong. Beyond the library of cross-platform apps that also support Linux (OBS Studio, VLC Media Player, Dropbox, etc.), there is usually at least one alternative to most popular Windows utilities and applications. Here are a few I use:

- Geary to manage email from multiple Gmail accounts

- Peek to capture quick screen recordings

- KDE Connect to sync my computer’s clipboard with my phone’s

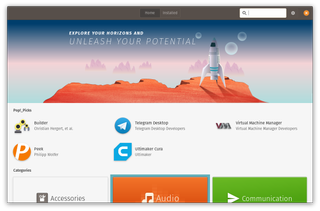

Most Linux distributions have a built-in app store where you can find software, but if you want to get a feel for what apps are available without booting into Linux, you can browse through Flathub or Snapcraft (repositories for packaged apps) in your browser. The app store on Pop_OS, called the “Pop!_Shop” (Image credit: Pop_OS)It’s easy to get the impression that using Linux requires understanding Terminal commands, but that’s definitely not the case anymore. While many guides for setting up tools and apps might reference commands, that’s usually because it’s easier to tell someone to type something in than to navigate through menus and apps that could vary for every user.There are more variations of desktop Linux than there are stars in the sky, but I ended up settling on Pop_OS, a distribution based on Ubuntu developed by System76 (one of the Linux PC makers I mentioned earlier). It has the wide software support of Ubuntu, but with a few modifications: more keyboard shortcuts, a tweaked theme, improved battery life, and other minor changes. Pop_OS has become a favorite among PC gamers with its built-in support for Nvidia graphics cards, so let’s discuss games. Gaming on LinuxPlaying most games on Linux used to require difficult workarounds and annoyingly specific hardware. That started to change after Steam officially became available for Linux in 2012, but even though Steam now lists thousands of compatible games, most triple-A games either ignore Linux entirely (Doom Eternal, The Witcher 3, GTA V) or receive ports several years later.Gaming on Linux has changed dramatically just in the last year. Mostly thanks, again, to Valve. In late 2018 Valve released the Proton compatibility layer and integrated it into the Steam client for Linux. Proton is a modified version of the Wine compatibility software that already allows thousands of Windows games and applications to work on Linux, but with added features (like improved Direct3D-to-Vulkan translation). Wine wasn’t very good at playing games with DirectX 9 or 11, but Proton makes a big difference.

The app store on Pop_OS, called the “Pop!_Shop” (Image credit: Pop_OS)It’s easy to get the impression that using Linux requires understanding Terminal commands, but that’s definitely not the case anymore. While many guides for setting up tools and apps might reference commands, that’s usually because it’s easier to tell someone to type something in than to navigate through menus and apps that could vary for every user.There are more variations of desktop Linux than there are stars in the sky, but I ended up settling on Pop_OS, a distribution based on Ubuntu developed by System76 (one of the Linux PC makers I mentioned earlier). It has the wide software support of Ubuntu, but with a few modifications: more keyboard shortcuts, a tweaked theme, improved battery life, and other minor changes. Pop_OS has become a favorite among PC gamers with its built-in support for Nvidia graphics cards, so let’s discuss games. Gaming on LinuxPlaying most games on Linux used to require difficult workarounds and annoyingly specific hardware. That started to change after Steam officially became available for Linux in 2012, but even though Steam now lists thousands of compatible games, most triple-A games either ignore Linux entirely (Doom Eternal, The Witcher 3, GTA V) or receive ports several years later.Gaming on Linux has changed dramatically just in the last year. Mostly thanks, again, to Valve. In late 2018 Valve released the Proton compatibility layer and integrated it into the Steam client for Linux. Proton is a modified version of the Wine compatibility software that already allows thousands of Windows games and applications to work on Linux, but with added features (like improved Direct3D-to-Vulkan translation). Wine wasn’t very good at playing games with DirectX 9 or 11, but Proton makes a big difference. (Image credit: CD Projekt RED)You can now play many Windows-only games on Linux using nothing more than the regular Linux Steam client. Features like controller support and the Steam overlay work as expected. The unofficial ProtonDB website lists more than 6,000 games that work when Steam Play is manually enabled; The Witcher 3, No Man’s Sky, Skyrim, and GTA V are all reported to work well across a wide range of PCs. It’s as simple as downloading the game to your PC through Steam and clicking play.Proton makes gaming on Linux easy and practical. And if you want to try Windows games that aren’t available through Steam, like League of Legends, Lutris is a popular option. The Lutris community maintains install scripts for many popular games.For the first time ever, it’s possible to play thousands of recently released PC games on Linux with next to no effort, and that’s something to get excited about.There are still some rough spotsWhile Linux on the whole has given me far fewer frustrations than Windows 10, it would be disingenuous of me to gloss over some of its remaining problems.Desktop environments on Linux are generally behind on recent trends in design and usability. One area where Windows has a clear lead over Linux is with high-DPI screens, like the 1440p and 4K panels found in many modern laptops. While Windows and most of the applications running on it can now scale to different display sizes perfectly, most desktop environments on Linux only support 100% or 200% scaling. There’s also no standard on the Linux desktop for dark mode, like there is on Windows and macOS—while most desktop environments allow you to change to a dark theme, apps using custom interfaces might have issues.Finally, most games generally perform worse on Linux than on Windows, though the difference varies. Compatibility layers like Wine and Proton slow down performance a bit, since they have to translate system API calls and other tasks to work on Linux.Take Linux for a spin

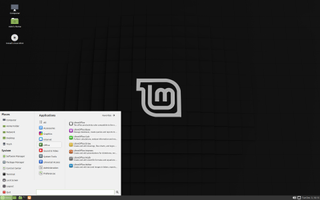

(Image credit: CD Projekt RED)You can now play many Windows-only games on Linux using nothing more than the regular Linux Steam client. Features like controller support and the Steam overlay work as expected. The unofficial ProtonDB website lists more than 6,000 games that work when Steam Play is manually enabled; The Witcher 3, No Man’s Sky, Skyrim, and GTA V are all reported to work well across a wide range of PCs. It’s as simple as downloading the game to your PC through Steam and clicking play.Proton makes gaming on Linux easy and practical. And if you want to try Windows games that aren’t available through Steam, like League of Legends, Lutris is a popular option. The Lutris community maintains install scripts for many popular games.For the first time ever, it’s possible to play thousands of recently released PC games on Linux with next to no effort, and that’s something to get excited about.There are still some rough spotsWhile Linux on the whole has given me far fewer frustrations than Windows 10, it would be disingenuous of me to gloss over some of its remaining problems.Desktop environments on Linux are generally behind on recent trends in design and usability. One area where Windows has a clear lead over Linux is with high-DPI screens, like the 1440p and 4K panels found in many modern laptops. While Windows and most of the applications running on it can now scale to different display sizes perfectly, most desktop environments on Linux only support 100% or 200% scaling. There’s also no standard on the Linux desktop for dark mode, like there is on Windows and macOS—while most desktop environments allow you to change to a dark theme, apps using custom interfaces might have issues.Finally, most games generally perform worse on Linux than on Windows, though the difference varies. Compatibility layers like Wine and Proton slow down performance a bit, since they have to translate system API calls and other tasks to work on Linux.Take Linux for a spin Mint resembles Windows with the Start Menu, while Elementary looks more like macOS. (Image credit: Mint)If you want to try out desktop Linux and see how it fares for your favorite games and everyday computing, I’d recommend starting with the Pop_OS distribution, since drivers for Nvidia’s graphics cards are built-in and well-supported (just make sure to download the Nvidia ISO). Steam is also available from the included app store.AMD works closely with the Linux kernel and Mesa graphics teams, so any recent Linux distribution works well with Radeon graphics cards—no need to even worry about proprietary drivers or installing anything extra. The same is also true for systems with Intel HD graphics.If you don’t like how Pop_OS looks or feels, there are plenty of other choices with varying desktop environments. Just about every desktop Linux OS offers a Live USB image, which you can toss onto a USB stick and boot from to experiment with before you install anything to your PC.Linux Mint is one of the most popular desktop distributions, and the ‘Cinnamon’ version mimics the Windows Start Menu and taskbar. There’s also Elementary OS, which aims to deliver a simple and consistent interface, or you could go with good ol’ Ubuntu. Keep in mind that if you have a PC with Nvidia graphics, you’ll have to find out how to install Nvidia’s drivers for your specific distribution—here’s a guide for the most popular distros.There’s a running gag with Linux users that each new year is the ‘Year of Linux’—the point when the OS finally becomes feature-complete with Windows and will dominate the computer market. Much like Voyager 1 leaving our solar system, the Year of Linux has been declared countless times. While 2020 may not be the definitive year (if there will ever be one), it’s certainly the easiest it’s ever been to give Linux a real try.

Mint resembles Windows with the Start Menu, while Elementary looks more like macOS. (Image credit: Mint)If you want to try out desktop Linux and see how it fares for your favorite games and everyday computing, I’d recommend starting with the Pop_OS distribution, since drivers for Nvidia’s graphics cards are built-in and well-supported (just make sure to download the Nvidia ISO). Steam is also available from the included app store.AMD works closely with the Linux kernel and Mesa graphics teams, so any recent Linux distribution works well with Radeon graphics cards—no need to even worry about proprietary drivers or installing anything extra. The same is also true for systems with Intel HD graphics.If you don’t like how Pop_OS looks or feels, there are plenty of other choices with varying desktop environments. Just about every desktop Linux OS offers a Live USB image, which you can toss onto a USB stick and boot from to experiment with before you install anything to your PC.Linux Mint is one of the most popular desktop distributions, and the ‘Cinnamon’ version mimics the Windows Start Menu and taskbar. There’s also Elementary OS, which aims to deliver a simple and consistent interface, or you could go with good ol’ Ubuntu. Keep in mind that if you have a PC with Nvidia graphics, you’ll have to find out how to install Nvidia’s drivers for your specific distribution—here’s a guide for the most popular distros.There’s a running gag with Linux users that each new year is the ‘Year of Linux’—the point when the OS finally becomes feature-complete with Windows and will dominate the computer market. Much like Voyager 1 leaving our solar system, the Year of Linux has been declared countless times. While 2020 may not be the definitive year (if there will ever be one), it’s certainly the easiest it’s ever been to give Linux a real try.